The news today said even though obie's team)dem's) seem ot be bailling out of politics quickly, the presidents approval ratings are still around fifty percent even with his agenda ratings falling fast sooooo...

Why has not this president been attack personally like the ones in the past would be by now had they failled to do....well...anything, in their first year of office as he has done?

Could it be because of race? Perhaps people will only say they do not like his agenda and not him because they are afraid of being called racist? Or is he as a persn really that likable that no matter how much he messes up or little he accomplishes, we still love him?

Obama's ratings

Moderator: Moderators

Post #31

Every successful country ever? Generally speaking it is the ones who don't tax and spend on infrastructure, education, healthcare, poverty, civil services, defenses, etc. that fall apart. Would you care to name any successful state that got where it was through not taxing and not spending?East of Eden wrote:I'm not saying tax increases were the sole reason for the depression, but they worsened and prolonged it. In 1937, the American economy fell, lasting through most of 1938. Production declined sharply, as did profits and employment. Unemployment went from 14.3% in 1937 to 19.0% in 1938.Wyvern wrote: Why do you continue trying to blame tax increases for the great depression when those tax increases went into effect only after the depression had hit bottom.

What country has taxed and spent its way into prosperity?

Poor financial regulation was the primary cause of the Great Depression, no amount of copying and pasting revisionist history right wing articles will change that.

- East of Eden

- Under Suspension

- Posts: 7032

- Joined: Sat Mar 28, 2009 11:25 pm

- Location: Albuquerque, NM

Post #32

Ridiculous question, nobody is saying to not tax at all. By your thinking we should raise rates back up to 90% right?Abraxas wrote:Every successful country ever? Generally speaking it is the ones who don't tax and spend on infrastructure, education, healthcare, poverty, civil services, defenses, etc. that fall apart. Would you care to name any successful state that got where it was through not taxing and not spending?East of Eden wrote:I'm not saying tax increases were the sole reason for the depression, but they worsened and prolonged it. In 1937, the American economy fell, lasting through most of 1938. Production declined sharply, as did profits and employment. Unemployment went from 14.3% in 1937 to 19.0% in 1938.Wyvern wrote: Why do you continue trying to blame tax increases for the great depression when those tax increases went into effect only after the depression had hit bottom.

What country has taxed and spent its way into prosperity?

Generally I use Wikipedia, is that a right wing source? Do you think Smoot-Hawley had nothing to do with the depression?Poor financial regulation was the primary cause of the Great Depression, no amount of copying and pasting revisionist history right wing articles will change that.

What I do challenge is the myth that FDR somehow saved capitalism and got us out of the depression. As Henry Morganthau Jr, FDR's secretary of the Treasury said:

"We have tried spending money. We are spending more than we have ever spent before and it does not work."

"I want to see this country prosperous. I want to see people get a job. I want to see people get enough to eat. We have never made good on our promises."

"I say after eight years of this Administration we have just as much unemployment as when we started. ... And an enormous debt to boot!"

"We are fooling ourselves if we imagine that we can ever make the authentic Gospel popular......it is too simple in an age of rationalism; too narrow in an age of pluralism; too humiliating in an age of self-confidence; too demanding in an age of permissiveness; and too unpatriotic in an age of blind nationalism." Rev. John R.W. Stott, CBE

Post #33

When trying to find the causes of an event I find it helpful to start looking before the event happened. In general the great depression is considered to have been sparked due to the stock market crash in the fall of 1929. Please tell me how a tax increase that was enacted AFTER your sources say the depression hit bottom could in any way be responsible for the depression? On the other hand if we look at the conditions prior to the stock market crash we see that it is a period of very low taxation along with very little regulation in the financial sector. Leading up to our current situation we see that similar conditions exist. Going from a historic perspective the formula for creating a major economic recession seems to be lowering greatly the taxes for the richest people and then letting them use that extra cash not to create jobs as your political party states would happen but to instead get pumped into the stock market which those same richest people have convinced the politicians is able to regulate itself.East of Eden wrote:I'm not saying tax increases were the sole reason for the depression, but they worsened and prolonged it. In 1937, the American economy fell, lasting through most of 1938. Production declined sharply, as did profits and employment. Unemployment went from 14.3% in 1937 to 19.0% in 1938.Wyvern wrote: Why do you continue trying to blame tax increases for the great depression when those tax increases went into effect only after the depression had hit bottom.

What country has taxed and spent its way into prosperity?

- East of Eden

- Under Suspension

- Posts: 7032

- Joined: Sat Mar 28, 2009 11:25 pm

- Location: Albuquerque, NM

Post #34

The crash may have been a sympton, not the cause. From Wikipeida:Wyvern wrote:When trying to find the causes of an event I find it helpful to start looking before the event happened. In general the great depression is considered to have been sparked due to the stock market crash in the fall of 1929.

There were multiple causes for the first downturn in 1929, including the structural weaknesses and specific events that turned it into a major depression and the way in which the downturn spread from country to country. In relation to the 1929 downturn, historians emphasize structural factors like massive bank failures and the stock market crash, while economists (such as Barry Eichengreen, Milton Friedman and Peter Temin) point to monetary factors such as actions by the US Federal Reserve that contracted the money supply, and Britain's decision to return to the Gold Standard at pre-World War I parities (US$4.86:£1).

Read my answer again. The tax increases could have prolonged and worsened the depression.Please tell me how a tax increase that was enacted AFTER your sources say the depression hit bottom could in any way be responsible for the depression?

I prefer to call them 'job creators'. Poor people don't give anyone a job. The taxes are lowered most for the rich because they pay the most taxes. How do you lower taxes for poor people who don't pay taxes?On the other hand if we look at the conditions prior to the stock market crash we see that it is a period of very low taxation along with very little regulation in the financial sector. Leading up to our current situation we see that similar conditions exist. Going from a historic perspective the formula for creating a major economic recession seems to be lowering greatly the taxes for the richest people

Then why did during the Reagan era we got an economic boom when we cut taxes?and then letting them use that extra cash not to create jobs as your political party states would happen but to instead get pumped into the stock market which those same richest people have convinced the politicians is able to regulate itself.

Again from Wikipedia:

According to a 1996 study[34] from the libertarian think tank Cato Institute:

On 8 of the 10 key economic variables examined, the American economy performed better during the Reagan years than during the pre- and post-Reagan years.

Real median family income grew by $4,000 during the Reagan period after experiencing no growth in the pre-Reagan years; it experienced a loss of almost $1,500 in the post-Reagan years.

Interest rates, inflation, and unemployment fell faster under Reagan than they did immediately before or after his presidency.

The only economic variable that was worse in the Reagan period than in both the pre- and post-Reagan years was the savings rate, which fell rapidly in the 1980s.

The productivity rate was higher in the pre-Reagan years but much lower in the post-Reagan years.

In the last year of the Carter Administration (1980) the US inflation rate climbed to a peak of 14.8%, the top individual tax payer rate was 78%, unemployment was 7.4%, federal outlay was 17% higher than the economy's growth rate, and the federal government grew while enacting loads of new spending programs. During this period, the US economy was the worst it had been since the Great Depression of the 1930s.[citation needed] The nation was in quite a deep hole of economic collapse when the new president Ronald Reagan took office in January 1981. Reagan had to devise a constructive, sound tax and monetary policy to pull the US out of its economic low point.

Stephen Moore of the Cato Institute stated that "no act in the last quarter century had a more profound impact on the US economy of the eighties and nineties than the Reagan tax cut of 1981." He claims that Reagan's tax cuts, combined with an emphasis on federal monetary policy, deregulation, and expansion of free trade created a sustained economic expansion creating America's greatest sustained wave of prosperity ever. The American economy grew by more than a third in size, producing a $15 trillion increase in American wealth. Every income group, from the richest, middle class and poorest in this country, grew its income (1981-1989). Consumer and investor confidence soared. Cutting federal income taxes, cutting the US government spending budget, cutting useless programs, scaling down the government work force, maintaining low interest rates, and keeping a watchful inflation hedge on the monetary supply was Ronald Reagan's formula for a successful economic turnaround. The economic principle that business expansion, jobs and wealth follow low tax rates is widely accepted.

"We are fooling ourselves if we imagine that we can ever make the authentic Gospel popular......it is too simple in an age of rationalism; too narrow in an age of pluralism; too humiliating in an age of self-confidence; too demanding in an age of permissiveness; and too unpatriotic in an age of blind nationalism." Rev. John R.W. Stott, CBE

Post #35

Worked very well for a very long time. During the most properous periods of American history the tax rate on the wealthiest was over 70%, moving it back to that level or more and putting the surplus income into developing infrastructure and growth programs would be a good start, just as soon as we closed the tax shelters.East of Eden wrote:Ridiculous question, nobody is saying to not tax at all. By your thinking we should raise rates back up to 90% right?Abraxas wrote:Every successful country ever? Generally speaking it is the ones who don't tax and spend on infrastructure, education, healthcare, poverty, civil services, defenses, etc. that fall apart. Would you care to name any successful state that got where it was through not taxing and not spending?East of Eden wrote:I'm not saying tax increases were the sole reason for the depression, but they worsened and prolonged it. In 1937, the American economy fell, lasting through most of 1938. Production declined sharply, as did profits and employment. Unemployment went from 14.3% in 1937 to 19.0% in 1938.Wyvern wrote: Why do you continue trying to blame tax increases for the great depression when those tax increases went into effect only after the depression had hit bottom.

What country has taxed and spent its way into prosperity?

Arthur Laffer is a right wing source. He is not a credible one either, considering in 2006 he was trumpeting how our economic policy was on the right track and that the good times would keep on rolling.Generally I use Wikipedia, is that a right wing source?Poor financial regulation was the primary cause of the Great Depression, no amount of copying and pasting revisionist history right wing articles will change that.

Of course not. It wasn't a leading cause however.Do you think Smoot-Hawley had nothing to do with the depression?

That's his opinion. Unfortunately, reality looks rather different. The inversments FDR made allowed us to grow and prosper as an economic power for decades afterwards. Well, that and the complete destruction of foreign industry.What I do challenge is the myth that FDR somehow saved capitalism and got us out of the depression. As Henry Morganthau Jr, FDR's secretary of the Treasury said:

"We have tried spending money. We are spending more than we have ever spent before and it does not work."

"I want to see this country prosperous. I want to see people get a job. I want to see people get enough to eat. We have never made good on our promises."

"I say after eight years of this Administration we have just as much unemployment as when we started. ... And an enormous debt to boot!"

Let me just start off by saying the Cato Institute is even less credible than Arthur Laffer.East of Eden wrote:

According to a 1996 study[34] from the libertarian think tank Cato Institute:

The problem is very little of this is actually true and it is mostly a case example of how you can make statistics say whatever you want them to.On 8 of the 10 key economic variables examined, the American economy performed better during the Reagan years than during the pre- and post-Reagan years.

Real median family income grew by $4,000 during the Reagan period after experiencing no growth in the pre-Reagan years; it experienced a loss of almost $1,500 in the post-Reagan years.

Interest rates, inflation, and unemployment fell faster under Reagan than they did immediately before or after his presidency.

The only economic variable that was worse in the Reagan period than in both the pre- and post-Reagan years was the savings rate, which fell rapidly in the 1980s.

The productivity rate was higher in the pre-Reagan years but much lower in the post-Reagan years.

In the last year of the Carter Administration (1980) the US inflation rate climbed to a peak of 14.8%, the top individual tax payer rate was 78%, unemployment was 7.4%, federal outlay was 17% higher than the economy's growth rate, and the federal government grew while enacting loads of new spending programs. During this period, the US economy was the worst it had been since the Great Depression of the 1930s.[citation needed] The nation was in quite a deep hole of economic collapse when the new president Ronald Reagan took office in January 1981. Reagan had to devise a constructive, sound tax and monetary policy to pull the US out of its economic low point.

Stephen Moore of the Cato Institute stated that "no act in the last quarter century had a more profound impact on the US economy of the eighties and nineties than the Reagan tax cut of 1981." He claims that Reagan's tax cuts, combined with an emphasis on federal monetary policy, deregulation, and expansion of free trade created a sustained economic expansion creating America's greatest sustained wave of prosperity ever. The American economy grew by more than a third in size, producing a $15 trillion increase in American wealth. Every income group, from the richest, middle class and poorest in this country, grew its income (1981-1989). Consumer and investor confidence soared. Cutting federal income taxes, cutting the US government spending budget, cutting useless programs, scaling down the government work force, maintaining low interest rates, and keeping a watchful inflation hedge on the monetary supply was Ronald Reagan's formula for a successful economic turnaround. The economic principle that business expansion, jobs and wealth follow low tax rates is widely accepted.

Points taken from the very next section in Wikipedia from the Reaganomics page:

Most of the key economic indicators that were better than before or after were middle of the road or poor when compared to the rest of the century.

To fight inflation he caused a recession 1982.

Real wages declined, so in fact, the poor and middle were not getting richer.

Consumer confidence soared because he convinced everyone to stop saving and start spending, a huge part of the current consumer debt state the US has become.

Nixon and Ford managed better numbers than Reagan did on the economics board while they had the recession between 1971 and 1980 to deal with.

He also shifted the tax burden from those who have money to those who don't, damaging the middle class.

We can quote articles at each other until the end of time, but the facts are the facts and the facts are Reagan was an economic trainwreck.

Last edited by Abraxas on Wed Feb 24, 2010 3:05 pm, edited 1 time in total.

- McCulloch

- Site Supporter

- Posts: 24063

- Joined: Mon May 02, 2005 9:10 pm

- Location: Toronto, ON, CA

- Been thanked: 3 times

Post #36

Just to be clear, when you are discussing tax rates do you mean average tax rates or marginal tax rates?

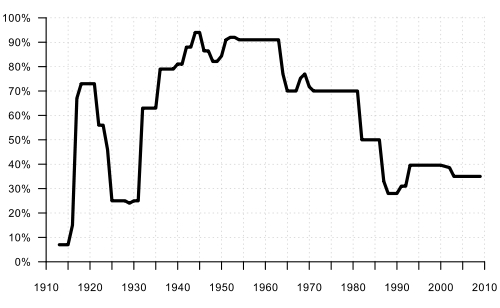

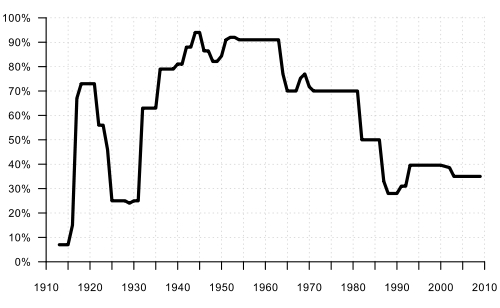

Top U.S. Federal marginal income tax rate from 1913 to 2009.

Someone might think from this that in the late 1950's there were people in the top tax brackets who actually had to pay 90% of their income in taxes. This impression would be in error.

Top U.S. Federal marginal income tax rate from 1913 to 2009.

Someone might think from this that in the late 1950's there were people in the top tax brackets who actually had to pay 90% of their income in taxes. This impression would be in error.

Examine everything carefully; hold fast to that which is good.

First Epistle to the Church of the Thessalonians

The truth will make you free.

Gospel of John

First Epistle to the Church of the Thessalonians

The truth will make you free.

Gospel of John

- East of Eden

- Under Suspension

- Posts: 7032

- Joined: Sat Mar 28, 2009 11:25 pm

- Location: Albuquerque, NM

Post #37

Correct, marginal.McCulloch wrote:Just to be clear, when you are discussing tax rates do you mean average tax rates or marginal tax rates?

Top U.S. Federal marginal income tax rate from 1913 to 2009.

Someone might think from this that in the late 1950's there were people in the top tax brackets who actually had to pay 90% of their income in taxes. This impression would be in error.

- East of Eden

- Under Suspension

- Posts: 7032

- Joined: Sat Mar 28, 2009 11:25 pm

- Location: Albuquerque, NM

Post #38

You mean like the '80s?Abraxas wrote:Worked very well for a very long time. During the most properous periods of American history

the tax rate on the wealthiest was over 70%, moving it back to that level or more and putting the surplus income into developing infrastructure and growth programs would be a good start, just as soon as we closed the tax shelters.

And you're a left-wing source. So what? Can we stick to facts? Which of Prof. Laffer's do you disagree with.Arthur Laffer is a right wing source.

Most people in 2006 didn't see it coming, did you? Here's what Barney Frank said when Bush tried to increase regulation:He is not a credible one either, considering in 2006 he was trumpeting how our economic policy was on the right track and that the good times would keep on rolling.

''These two entities -- Fannie Mae and Freddie Mac -- are not facing any kind of financial crisis,'' said Representative Barney Frank of Massachusetts, the ranking Democrat on the Financial Services Committee. ''The more people exaggerate these problems, the more pressure there is on these companies, the less we will see in terms of affordable housing.''

And as FDRs secretary of the Treasury, it should carry a lot more weight than we internet warriors.That's his opinion.

Your ad hominen objections don't constitute a debate. From Wikipedia:Let me just start off by saying the Cato Institute is even less credible than Arthur Laffer.

The Institute's stated mission is "to broaden the parameters of public policy debate to allow consideration of the traditional American principles of limited government, individual liberty, free markets, and peace" by striving "to achieve greater involvement of the intelligent, lay public in questions of (public) policy and the proper role of government." Cato scholars conduct policy research on a broad range of public policy issues, and produce books, studies, op-eds, and blog posts. They are also frequent guests in the media.

The Cato Institute is non-partisan, and its scholars' views are not consistently aligned with either major political party. For example, Cato scholars were sharply critical of George W. Bush's administration (2001–2009) on a wide variety of issues, including the Iraq war, civil liberties, education, agriculture, energy policy, and excessive government spending. However, on other issues, most notably health care[1] Social Security,[2][3] global warming,[4] tax policy,[5] and immigration,[6][7][8][9][10] Cato scholars had praised Bush administration initiatives. During the 2008 U.S. presidential election, Cato scholars criticized both major-party candidates, John McCain[11][12] and Barack Obama.[13][14]

He inherited a recession. Did FDR also cause the 1937 recession?Points taken from the very next section in Wikipedia from the Reaganomics page:

Most of the key economic indicators that were better than before or after were middle of the road or poor when compared to the rest of the century.

To fight inflation he caused a recession 1982.

Income increased for all income groups.Real wages declined, so in fact, the poor and middle were not getting richer.

Reagan passed away years ago, and has nothing to do with our current crisis.Consumer confidence soared because he convinced everyone to stop saving and start spending, a huge part of the current consumer debt state the US has become.

Reducing the misery index from 19.99% to 7.5% isn't a train wreck. For that, see Obama.We can quote articles at each other until the end of time, but the facts are the facts and the facts are Reagan was an economic trainwreck.

"We are fooling ourselves if we imagine that we can ever make the authentic Gospel popular......it is too simple in an age of rationalism; too narrow in an age of pluralism; too humiliating in an age of self-confidence; too demanding in an age of permissiveness; and too unpatriotic in an age of blind nationalism." Rev. John R.W. Stott, CBE

Post #39

The point being you can't blame the great depression on something that happened after it had already started which is what you are trying to do.East of Eden wrote:The crash may have been a sympton, not the cause. From Wikipeida:Wyvern wrote:When trying to find the causes of an event I find it helpful to start looking before the event happened. In general the great depression is considered to have been sparked due to the stock market crash in the fall of 1929.

It did not worsen according to your sources since they say it was the worst in 1933. So your conclusion would be to simply continue the same policies that were in place when the depression started? They couldn't realistically lower taxes much more than they were in 1929 and yet even so unemployment skyrocketed. The connection between tax rates and job growth rates does not follow and to think that is the only factor in how jobs are created is simplistic at bestRead my answer again. The tax increases could have prolonged and worsened the depression.Please tell me how a tax increase that was enacted AFTER your sources say the depression hit bottom could in any way be responsible for the depression?

If you actually wanted to give a break to the job creators you would be giving those tax breaks to the middle class. The great majority of jobs are created from small businesses owned by middle class people, not corporations and not rich people.I prefer to call them 'job creators'. Poor people don't give anyone a job. The taxes are lowered most for the rich because they pay the most taxes. How do you lower taxes for poor people who don't pay taxes?On the other hand if we look at the conditions prior to the stock market crash we see that it is a period of very low taxation along with very little regulation in the financial sector. Leading up to our current situation we see that similar conditions exist. Going from a historic perspective the formula for creating a major economic recession seems to be lowering greatly the taxes for the richest people

It took a long time for the financial sector regulations from the great depression to get repealed. You may have noticed when I wrote that it takes two factors to create a really big recession. You may also remember during the first Bush's presidency that we had a bank crisis that was due to less regulation in one area.Then why did during the Reagan era we got an economic boom when we cut taxes?and then letting them use that extra cash not to create jobs as your political party states would happen but to instead get pumped into the stock market which those same richest people have convinced the politicians is able to regulate itself.

- East of Eden

- Under Suspension

- Posts: 7032

- Joined: Sat Mar 28, 2009 11:25 pm

- Location: Albuquerque, NM

Post #40

You're answering a point I never made.Wyvern wrote:The point being you can't blame the great depression on something that happened after it had already started which is what you are trying to do.

What about the 1937 recession?It did not worsen according to your sources since they say it was the worst in 1933.

Again, your answering a point I never made. When did I say it was the only factor? Few economists would deny there is a link. More money needed to pay taxes means less money to hire people. Similarly, when the minimum wage and other employee benefits go up, fewer employees will be hired.The connection between tax rates and job growth rates does not follow and to think that is the only factor in how jobs are created is simplistic at best

It is ironic to see Obama complain about companies moving overseas when it is his policies they are fleeing, i.e. more taxes and regulation.

Many of these middle class job creators are incorporated and are 'rich' by Obama's definition, i.e. making $250,000+. In the course of my job I meet many of these people. They often live in modest houses and drive modest cars, save and invest wisely. Yet now the government makes these people who provide jobs, goods and services (unlike government) to be the villain.If you actually wanted to give a break to the job creators you would be giving those tax breaks to the middle class. The great majority of jobs are created from small businesses owned by middle class people, not corporations and not rich people.

"We are fooling ourselves if we imagine that we can ever make the authentic Gospel popular......it is too simple in an age of rationalism; too narrow in an age of pluralism; too humiliating in an age of self-confidence; too demanding in an age of permissiveness; and too unpatriotic in an age of blind nationalism." Rev. John R.W. Stott, CBE